What are the debt collection laws in Florida? Do borrowers and creditors have rights and responsibilities? How long is the duration before a debt becomes uncollectible in Florida?

Lenders, debt collectors and borrowers in Florida have rights and obligations under state and federal law. These laws protect the parties’ interests and help maintain a sound credit industry. It’s essential to follow the regulatory guidelines to avoid adverse legal implications.

Florida has two primary laws regulating debt collection:

The Federal Debt Collection Practices Act (FDCPA) is a federal law that was enacted in 1978 to protect borrowers against abusive, deceptive and unfair debt collection practices. The FDCPA applies to third-party collectors and does not extend to creditors. Additionally, it only applies to consumer debts, such as personal, family and household loans. It excludes business debt.

Under the law, debt collectors are individuals or companies that regularly collect or attempt to collect debt. A company that collects its own debts using another name other than its own may also qualify as a debt collector. These include third-party debt collectors, debt collection agencies, collection attorneys acting as debt collectors and debt buyers.

The Florida Consumer Collection Practices Act is a state law that protects debtors against unfair debt collection practices. It contains most of the FDCPA provisions but extends its scope. This act applies to original creditors and third-party debt collectors, unlike its federal counterpart.

This law requires debt collection agencies in Florida to be registered and renew their registration annually. However, this requirement excludes specific individuals and institutions, including the following:

In addition to the Florida Consumer Collection Practices Act, Florida state law includes the Florida Commercial Collection Practices Act. This law regulates commercial and business debt.

Below are some critical rights of borrowers in Florida:

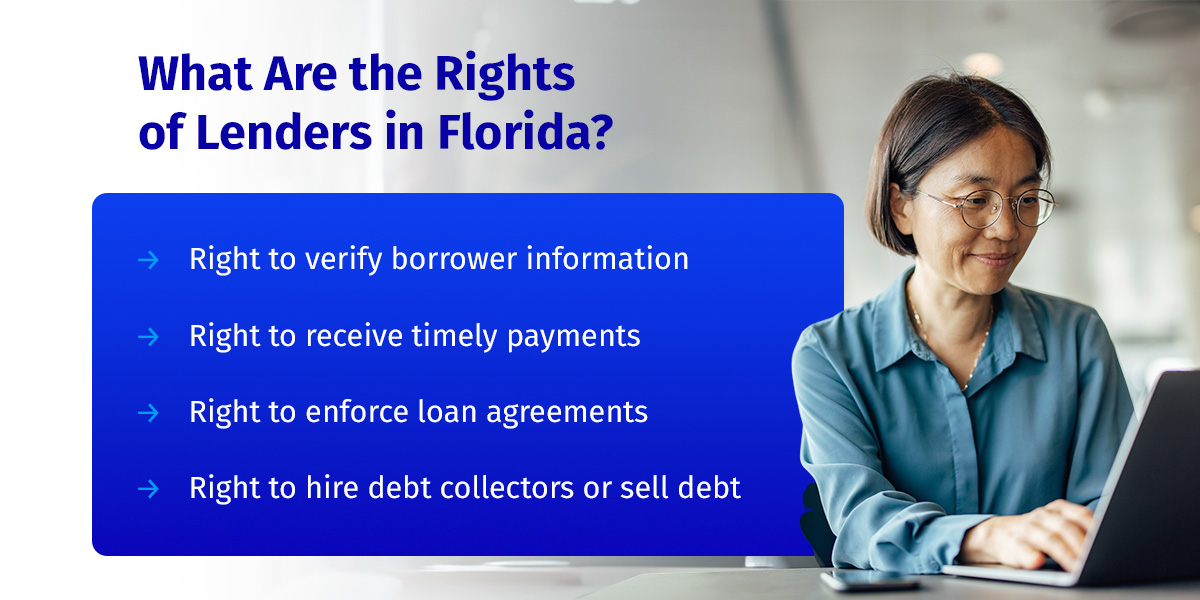

A few examples of lender rights in Florida include:

Florida’s debt collection laws prohibit debt collectors from abusive, deception and unfair debt practices, including the following:

Florida law allows debt collectors and lenders to take action to protect their interests:

Florida law allows borrowers to sue to recover damages if debt collectors violate their rights under the debt collection laws. Borrowers can also file a complaint with the Federal Consumer Financial Protection Bureau and the Florida Office of Financial Regulation.

The limitation period for debt recovery in Florida is five years for written contracts. For oral contracts, the limitation period is four years. If the lender obtains a judgment against the borrower, they must enforce it within 20 years. The limitation period starts when a missed payment is due or the date the liability occurred. It may restart if the borrower makes a new payment or executes a fresh contract to pay the outstanding amount.

Lenders may lose their right to sue borrowers to enforce the loan agreement when the limitation period passes. Although the lender may attempt to use non-judicial means to recover the debt once the limitation period passes, the debtor is under no legal obligation to comply. Lenders must act quickly if they intend to safeguard their interests.

Debt collectors, creditors and borrowers have rights and responsibilities under state and federal law. These laws are designed to protect the interests of the parties and preserve the sanctity of the credit industry. Although creditors can sue to enforce their rights, they must act quickly when dealing with debtors.

Southwest Recovery Services, LLC (SWRS) provides practical debt recovery solutions to creditors. We have multiple offices across the nation, including a location in Tampa. The professionals at SWRS have years of experience in the industry and deep knowledge of state and federal laws. Do you want to learn more about our offerings? Contact us now!